In this article, we introduce a three-piece set for grabbing the money circulation. The three-piece set is the circular flow diagram, a definition of nominal GDP, and the quantity equation (Fisher's equation of exchange). These items are independent in the modern economics. We integrate them for the money circulation. As a conclusion, we obtain M=G+I=S+T and V=Y/(G+I).

The contents of this article are as follows.

- Description of the 3-piece set.

- Integration of the 3-piece set.

- Two money flows.

- A money circulation from nominal GDP.

1. 3-piece set

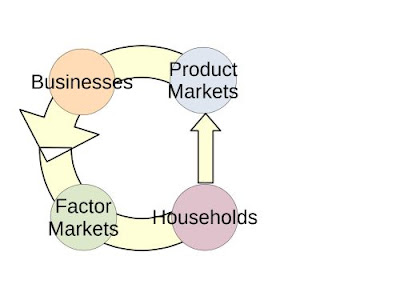

Our 3-piece set is the circular flow diagram, a definition of nominal GDP, and the quantity equation. First is the circular flow diagram. If you do not know it, you can find images of the circular flow diagram via image search.

The arrows in this figure show the flow of money. The thickness of the arrow indicates the amount of money. The disagreement in this figure can be resolved by taking into account government and financial markets.

Second is the definition of nominal GDP (without imports and exports).

- Y = C + G + I = C + T + S

Y is the nominal GDP, C is the consumption expenditure from the households to the product markets, G is the government expenditure to the product markets, I is the investment from the financial markets to the product markets, T is the tax from the households to the government, and S is the savings from the households to the financial markets. There are two keywords here, "from the households" and "to the product market". The common term C contains these two keywords.

Third is the quantity equation in the following form.

- MV = PQ

M is the total amount of money passing through the product market, V is the average circulation speed of money, P is the average price of all goods and services, and Q is the total amount of all goods and services. This equation shows an equality between two elements. One is the amount of money that has passed through the goods and services market over a period of time, and another is the goods and services sold in the product (=goods and services) markets.

The point to note is the average distribution speed V. You have to define it properly. This rotation speed V increases by +1 when money passes through the goods and services market, and Q also increases.

Including this article, I do not emphasize the concept of "speed". The concept of velocity seems valid in the United States in 1911 when Irving Fisher proposed this formula. This is because there are many people who live on that day, there are many small shops, and money management is sloppy. However, in modern Japan, many people live on a monthly salary. Therefore, the speed is fixed.

2. Integration of 3-piece set

Let us integrate our 3-piece set. First, we integrate the circular flow diagram and the definition of nominal GDP. The following is the result.

In order to explain `2-piece' without contradiction, we assume the government and financial markets outside the circular flow diagram. From this, a money flow (T+S) is from the households to the outside (= the government and the financial markets), and a money flow (G+I) is from the outside to the product markets.

We conclude that two different definitions of GDP, Y = C+S+T = C+G+I, are measurements of money flow in two different cross sections, as is shown in the above figure.

Next, let us consider MV = PQ. The following process is the money circulation explained from the above circular flow diagram.

- Money flows from the outside into the product markets.

- Money flows from the product markets to the households, and then flows from the households to the product markets. This cycle repeats several times.

- Finally, money flows from the households to the outside.

This leads that money first pass through the product markets as G+I, then pass through the product markets as C. If money G+I pass through the product markets three times, we obtain Y = 3(G+I) = G+I+C. As a result, we obtain the following relations from the quantity equation.

- M=G+I=T+S

- V=Y/(G+I)

We conclude that nominal GDP shows the number of rotations of money in the money circulation. These relations are more reasonable than those of the quantity theory of money.

3. Two money flows

Here, let us consider two money flows for simply interpreting the actual money flow. This `two' indicates two money velocities, v1 and v2, and v2 = v1+1. The amount of money is m1 and m2, and then nominal GDP is shown as,

- Nominal GDP = m1v1 + m2v2.

We divide this whole by G+I = m1+m2.

- Nominal GDP / (G+I) = (m1v1 + m2v2) / (m1+m2)

This equation shows that nominal GDP/(G+I) is the average value of v1 and v2 weighted by m1 and m2. From nominal GDP/(G+I), we obtain v1 and v2. Next we obtain m1 and m2 from the above relation.

These values are the outline of the money circulation.

4. A money circulation from nominal GDP

In 2017, nominal GDP of Japan was 546.5 trillion yen and household consumption was 295.4 trillion yen. Therefore, G + I = 250 trillion yen. From these values, we obtain the following results, under the assumption of two money flows.

- Nominal GDP / (G + I) = V ~ 2.2

- m1 / m2 ~ 4

From these, for v1=2, the money amount m1 is 200 trillion yen, and for v2=3, the money amount m2 is 50 trillion yen.

In summary, for Japanese nominal GDP in 2017, 200 trillion yen passes through the product markets twice, and 50 trillion yen passes through the product markets three times.

This estimation give a great limit on the reality of money circulation. For example, in Japan today, it is unlikely that 50 trillion yen passes through the product markets nine times. The author thinks that this derivation is a good hypothesis for quantitatively explaining the monetary circulation.

During the last 50 years, the quantity theory of money cannot give people these values. Now we can reject the conventional derivation of V with M2 and M3.

Our original article in Japanese「【貨幣循環】貨幣循環導入の3点セット」

Link page: Contents for money circulation

No comments:

Post a Comment